Advertise on Spain Property Portal.com at less than our 2015 prices!LIMITED OFFER FOR THE FIRST "500" NEW AGENTS! |

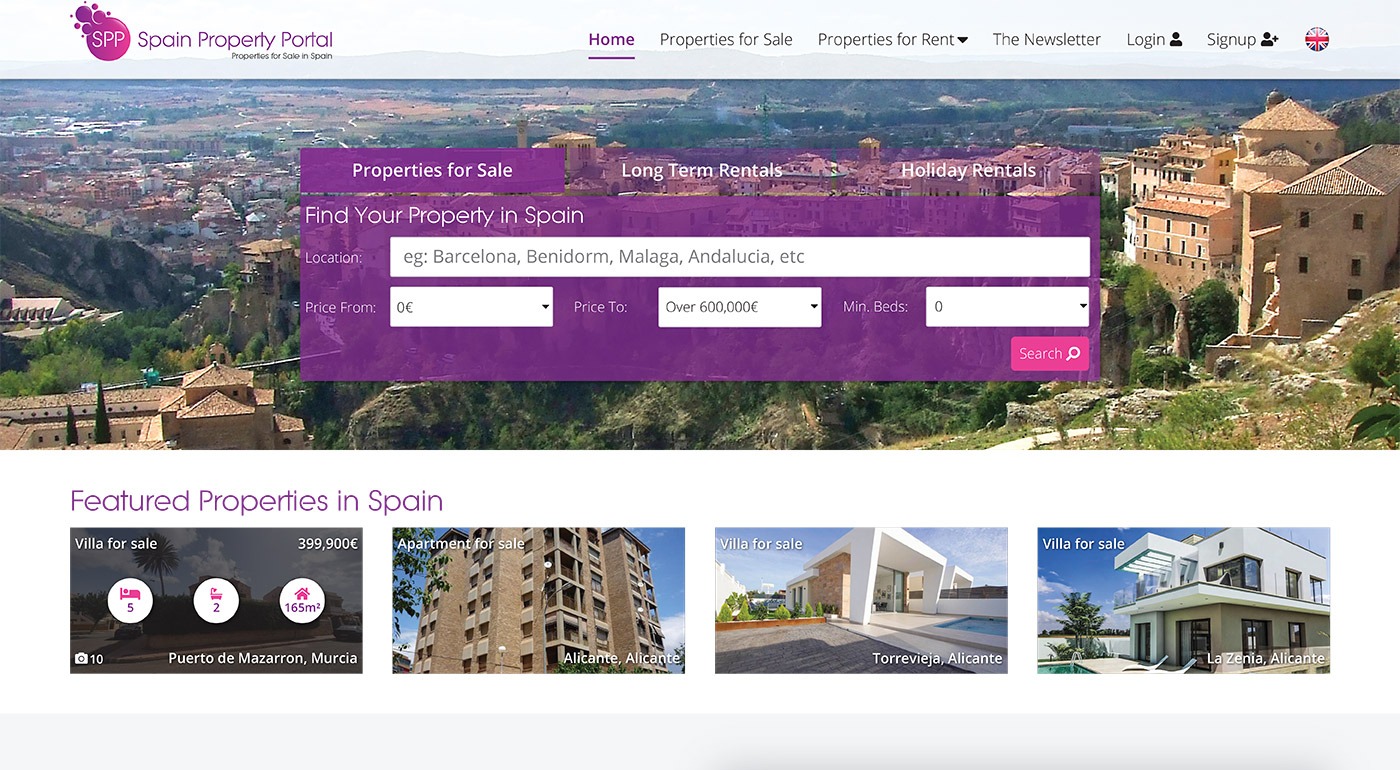

Advertise your properties on Spain Property Portal.com.

Unlike most property portals in Europe, we don't limit the number of properties you can advertise.

We offer two methods of payment, Paypal and Card payment. Payments are normally confirmed immediately, so your properties will be published the following day.

We offer three choices of advertising length, 3 months, 6 months and one year. Advertising for one year offers a better value for money and price per month. Simply choose the advert length that best suits your needs and budget:

- 3 months gives you up to 5 Featured Properties and 2 Hot Properties (Premium)

- 6 months gives you up to 5 Featured Properties and up to 2 Hot Properties (Premium)

- 12 months gives you up to 5 Featured Properties and up to 2 Hot Properties (Premium)

*FEATURED AND HOT PROPERTIES PROVIDE 3 TIMES MORE ENQUIRIES THAN NORMAL LISTINGS*

Please note: The featured and hot properties are displayed in rotation.

VAT/IVA INFORMATION

If you are a registered Spanish company with a CIF/NIF number - (applicable to CB/SL or SLu) - then VAT will not be charged if you can provide your Spanish tax reference number. If you are operating as a self-employed (Autonomo) you should provide an international vat number, or you will be required to pay UK VAT at 20%. If you are a UK registered Spanish Property Agent, remitting from a UK bank account, then the standard VAT rate of 20% will be added to your payment invoice. This amount may or may not be offset against your purchase. Your UK accountant will provide further information on request.

If you are a private seller wishing to advertise your own property, please visit our private sellers signup page

Choose Your Plan Below |

|

3 months advertising (from only 99€ + IVA) |

|

6 months advertising (from only 149€ + IVA) |

|

12 months advertising (from only 199€ + IVA) |

Just click on the box that you want.

3 maanden adverteren voor onbeperkte eigendommen

33,00€ per maand (39,60€ inc. VAT)

Totale prijs: 99,00€ (118,80€ inc. VAT)

6 maanden adverteren voor onbeperkte eigendommen

24,83€ per maand (29,80€ inc. VAT)

Totale prijs: 149,00€ (178,80€ inc. VAT)

12 maanden adverteren voor onbeperkte eigendommen

16,58€ per maand (19,90€ inc. VAT)

Totale prijs: 199,00€ (238,80€ inc. VAT)

Spaans onroerend goed nieuws & updates door Spain Property Portal.com

In Spain, two primary taxes are associated with property purchases: IVA (Value Added Tax) and ITP (Property Transfer Tax). IVA, typically applicable to new constructions, stands at 10% of the property's value. On the other hand, ITP, levied on resale properties, varies between regions but generally ranges from 6% to 10%.

Spain Property Portal is an online platform that has revolutionized the way people buy and sell real estate in Spain.

In Spain, mortgages, known as "hipotecas," are common, and the market has seen significant growth and evolution.